Job Profitability Notes

Tip

- This report is best used with the 'Open Jobs' filter since its main use is for management of Jobs in Progress. i.e. Identifying problems before the Job is closed.

- The 'Value of Time' is more accurate if Employee Rates are entered from Setup -> Employees, Rates & Costs p.h tab. At the very least, the 'Default Hourly Rate' should be entered as this is used where the Employee's Hourly Rate is not specified.

It is possible to automatically update Hourly Rates from Hourly Costs / Salaries. See How to Automatically Update Rates from Salaries/ Cost in Chase Insight for more information.

It is also possible to sort by Designation and then 'grab and drag' a figure for bulk updating of values for similar staff. See How to use the Grab and Drag Functionality in Chase Insight for further help on this.

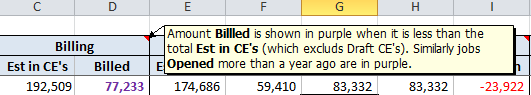

The tiles of the report columns have Excel comments (see below) that describe what each column does.

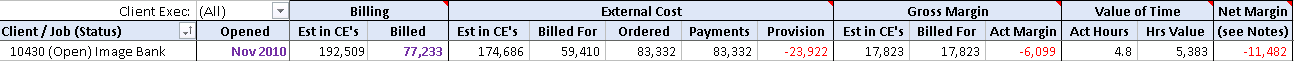

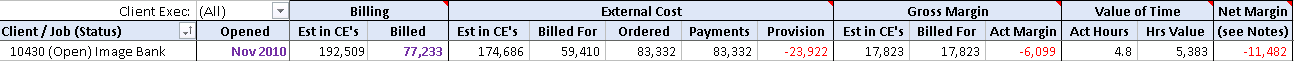

Let's look at a typical problem Job to understand how these figures are used. Take the job shown below:

- The job was Opened more than a year ago, thus the date appears in purple.

- Billing of 192,509 is Estimated in CE's, but only 77,233 is Billed, hence the Billed figure is in purple. Either a valid (not Draft) CE is not billed, or the billing was

credited.

- External Costs of 174,686 were Estimated in CE's. Because only some of the CE's are Billed only 59,410 of the cost is Billed For. However 83,332 costs were Ordered and

all of this 83,332 was captured for Payment. Note that Payments will be shown in red if they exceed the Ordered amount.

- The Provision for External Cost is calculated as follows: we can reasonably assume that an estimated cost from a supplier is likely once that cost is Billed For. Hence the

Provision is the estimated cost that is Billed For, less the Payments to Suppliers that are captured. In this case the Payments exceed the costs provided for in billings,

hence the Provision is negative. This is not ideal as it means that supplier costs have not been covered by Billing, thus it is shown in red. When the job is Closed the

Provision figure has a different context. Since no more costs are expected it now represents additional Margin from External Costs (remember that it is the difference

between estimated costs billed and actual payments). If this job is Closed now, Chase will generate a Cost Variance Statement of -23,922, thus recognising a loss.

- Gross Margin or Gross Profit is the Total Billing less External Cost. The three figures are calculated as follows:

- Gross Margin Est in CE's = Billing Est in CE's less External Cost Est in CE's.

- Gross Margin Billed For = Total Billed less External Cost Billed For. This figure is used extensively in Chase Billing Reports.

- Gross Act Gross Act Margin = Total Billed less the actual Payments to Suppliers captured in Chase.

- The Value of Time is for 4.8 Actual Hours recorded in Timesheets for the Job, multiplied by the charge out Rate (not Cost) of the staff who worked on the Job.

The Default Rate is used if not specified against Employees in Insight.

- The Net Margin is the Gross Act Margin of -6,099 less the Value of Time spent on the Job of 5,383. This shows a Net Margin of -11,482 which is shown in red as it is a loss.

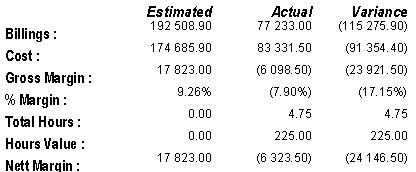

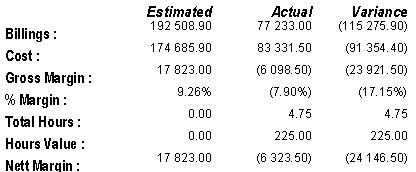

To see what the figures correlate to in Chase, it's best to look at a Chase Job Recon Statement. In the summary section (see below) you will see:

- The Estimated and Actual figures for Billing correspond to the Billing of 192,509 Estimated in CE's and the Actual 77,233 Billed.

- The Estimated and Actual figures for Cost correspond to the External Cost of 174,686 Estimated in CE's and the 83,332 Actual Payment.

- The Estimated figure for Gross Margin corresponds to the Estimated Margin of 17,823 Estimated in CE's. The Actual figure corresponds to the Estimated Margin

of 17,823 that is Billed For plus the Provision for costs of -23,922 (remember this also represents the extra profit or loss made on External Costs).

This equals -6,099.

- The Total Hours is the same as the Act Hours shown in Cost of Time, however the Hours Value differs as the Job Profitability report is based on the charge out

Rate of the staff who worked on the Job, whereas the Job Recon is based on Cost staff (which is less than the charge out Rate). The Net Margin differs accordingly.

Note: The total Provision at the bottom of the Open Jobs report is the same as the total provision on the Chase WIP report.

A good way to use the report is to distribute it to each Business Group Head / Account Director.

For help on analysing Client Profitability, refer to How to Analyse Client Profitability in Chase Insight